VALUING CONTRACTORS

Payroll to Suit Your Professional Circumstances

ET Payroll offers a comprehensive range of contractor payroll solutions to cater for all assignment-based projects, temporary contracts and joint employment models. Given the accelerated growth of the contracting sector and the advent of different working arrangements, our full-service capability ensures all contractors are advised as to the most appropriate solution for their professional circumstances. These include umbrella, PAYE, the increasingly popular joint employment model, CIS (Construction Industry Scheme) and PSC/ Limited Company for the self-employed.

The full-service provision ensures that we offer contractors a payroll solution fully synchronised with their career path and with the flexibility to cater for all assignments irrespective of referring agency, contract rates, payment terms, industry or sector. We strive to build long-term relationships with all our contractors and to provide a payroll facility which seamlessly adapts to their individual requirements over time.

Instant Registration Form

Umbrella ‘Employed’ Solution

![]()

Still one of the most popular payroll options for contractors, the ET Payroll umbrella model is an ‘employed’ solution which gives contractors all the benefits of a traditional employment contract. These include entitlements to sick and maternity/ paternity pay, a choice of holiday pay options, pension provision and overarching employee rights. With tax and National Insurance contributions paid at source, the umbrella option is both hassle-free and fully compliant.

Joint Employment Arrangements

![]()

Increasingly complex supply chain structures in a variety of sectors have fuelled the popularity of so-called Joint Employment arrangements whereby responsibilities for the contractor are shared between ET Payroll and the recruitment agency or the end-user client. Particularly prevalent in the health and social care sectors, these arrangements offer flexibility to all entities whilst giving full employment rights and entitlements to the worker.

PAYE ‘Employed’ Model

![]()

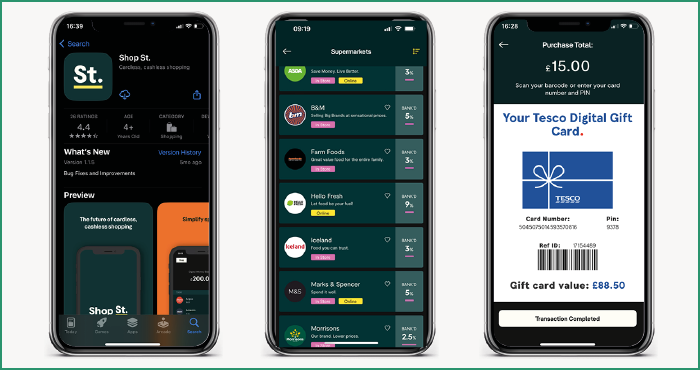

Paid and taxed using the PAYE system, contractors benefit from full employment rights and entitlement to sick and maternity/paternity pay, plus a choice of holiday pay and pension options. Slightly different from the umbrella model in that contractors might be considered to be employed only for the length of any given contract or assignment. As with all contractors registered with ET Payroll, this solution includes a free subscription to the Free Shop St. App.

Limited Company & PSC

![]()

Self-employed contractors working through their own limited company or personal service company can access a portfolio of financial and taxation services via ET Payroll. We have unrivalled experience in the self-employed contractor sector and will be delighted to assist you with aspects of your business.

Free Shop St. App

All contractors registered with ET Payroll are given a free subscription to the Shop St. employee benefits App where you can access a vast selection of money-saving discounts and special offers from a myriad of retailers and service providers.

These include all major supermarkets, High Street outlets & online retailers, fashion & beauty brands, home & garden products, restaurants & cafes, entertainment chains and wellbeing & health organisations, plus an invaluable discounted fuel card redeemable at Morrisons forecourts.

Many of our contractors are saving up to £2000 per year by regularly using the Shop St. App.

Compliant Payroll

Protecting the interests of the Contractor Supply Chain